Exploring Navy Federal Credit Union Business Loans

May 15, 2024 By Triston Martin

Navy Federal Credit Union provides a variety of business loans designed specifically for entrepreneurs and small business proprietors. Such loans may give crucial funds to assist in growing a business, including covering costs like buying equipment or handling expansion projects as well as fulfilling working capital requirements. This review will explore the specifics of Navy Federal Credit Union's business loan products, who can apply for them, and how the benefits they offer as well as any possible disadvantages it might have.

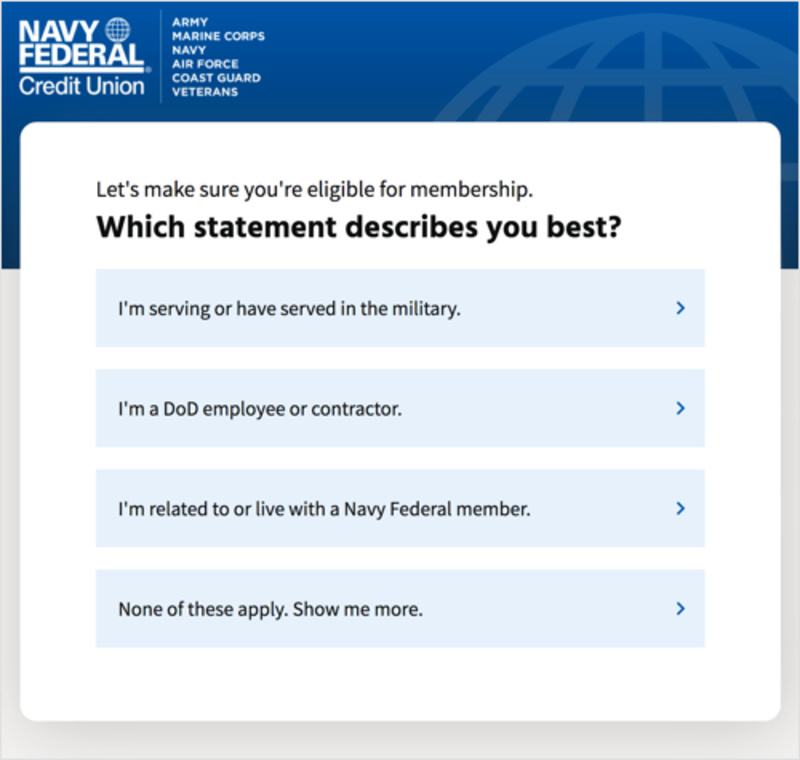

Eligibility Requirements

For getting a business loan from Navy Federal Credit Union, you need to fulfill some eligibility conditions. Usually, applicants should possess good credit scores along with a strong plan for their business and enough collateral that can be used as security against the loan. Moreover, the credit union might expect applicants to show a specific level of revenue and operating history in businesses. If you meet these requirements, it shows you have financial stability and the ability to repay the loan. This increases your chances of getting approval for a loan.

For eligibility, the applicants need to know that the Navy Federal Credit Union reviews each application in its unique way. A good credit score and collateral are significant but the credit union also takes into account overall financial well-being as well as the future potential of business. Showing a clear comprehension of business's money matters and future estimates can make the application stronger. Besides, applicants must be ready to give thorough clarifications or paperwork for any inconsistencies or questions that arise during the review.

- Documentation Requirements: Alongside financial statements, applicants may need to provide legal documents such as articles of incorporation or partnership agreements, depending on the business structure.

- Financial Stability Consideration: Navy Federal Credit Union may evaluate the stability of the industry in which the business operates to assess its long-term viability and repayment capacity.

Loan Options

Navy Federal Credit Union presents different types of business loans to adapt to various financing demands. These consist of term loans, lines of credit, commercial real estate loans, and Small Business Administration (SBA) ones. The term loan provides you with a one-time capital sum that needs to be returned in set periods while the line of credit gives you access to funds for fresh or constant costs. Loans for commercial real estate help in buying or refinancing properties, and SBA loans provide government-supported financing options with good conditions for suitable businesses.

Other than common loan options, Navy Federal Credit Union could have specific programs or benefits for particular industries or aims. For instance, they might provide certain loan products designed specifically for veterans with better conditions like reduced interest rates. Moreover, the union may give tools or support to help businesses deal with the complexities of applying for SBA loans. This can be very useful, especially if these firms are new to government-supported financing possibilities.

- Industry-Specific Programs: Navy Federal Credit Union may have partnerships or programs tailored for specific industries such as healthcare, technology, or agriculture, offering specialized financing solutions or expertise.

- Loan Bundling Options: Businesses may have the opportunity to bundle multiple loan products or services, such as business checking accounts or merchant services, for added convenience and potential cost savings.

Application Process

The application process for Navy Federal Credit Union business loans is not complex, but it does require a good deal of information. Normally, you fill out an application form online in which you provide details about your business as well as financial statements and personal history. The credit union might ask for more documents such as tax returns, licenses of the business, and bank statements to evaluate how healthy your finances are and if they can trust you with credit. After you apply, the credit union will go through it and might do a more careful examination before deciding on lending.

To make the application process faster, it is good if applicants have all the necessary documents and information ready. This includes having recent financial statements, business plans, and legal paperwork prepared. Keeping in contact with the credit union during this time will help manage any questions or worries that might arise quickly - possibly speeding up how fast they review and approve your application.

- Communication Channels: Navy Federal Credit Union offers multiple communication channels for applicants to reach out with questions or inquiries, including phone support, email, and online chat services.

- Loan Officer Assistance: Applicants may have access to dedicated loan officers or advisors who can provide personalized guidance and assistance throughout the application process.

Pros and Cons

As with all money items, Navy Federal Credit Union business loans have good and bad points. The main advantage is the credit union's low interest rates and adjustable terms that can assist businesses in saving on finance expenses as well as efficiently managing their cash flow. Furthermore, Navy Federal Credit Union provides individualized service along with devoted aid for borrowers to walk through the loan procedure. However, there are potential negatives to consider. This involves stringent qualifying criteria, slower processing times in comparison with other lenders, and restricted availability for some loan types or sectors.

Businesses should think deeply about the advantages and disadvantages of getting a business loan from Navy Federal Credit Union. Even though the low interest rates and customized service may seem appealing, businesses need to take into account their economic steadiness, how urgently they need financing, as well as the particular demands of their industry. Furthermore, businesses might wish to examine other methods or lenders for acquiring funds so that they can compare interest rates along with terms and eligibility requirements before finalizing obtaining a loan through Navy Federal Credit Union.

- Customer Support Accessibility: Navy Federal Credit Union offers extended customer support hours, including evenings and weekends, to accommodate business owners' busy schedules and provide timely assistance.

- Transparent Fee Structure: The credit union provides clear and transparent information regarding fees, interest rates, and repayment terms upfront, allowing borrowers to make informed decisions without hidden surprises.

Conclusion

To sum up, different business loans provided by Navy Federal Credit Union are created to assist a variety of requirements for entrepreneurs and small business proprietors. They aim to give businesses the power they need with low rates, adaptable periods, and customized attention that sets them apart from other lenders. If you understand who can apply, look into the type of loan on offer, and understand its positive and negative sides - it will help in deciding on using Navy Federal Credit Union for your business financing needs. From financing plans for business expansion to buying equipment or paying operational costs, Navy Federal Credit Union business loans can provide valuable assistance in reaching your specific objectives and boosting growth.

-

Investment May 15, 2024

Investment May 15, 2024What is Level-Premium Insurance: What You Need to Know

Level-premium insurance offers stability and peace of mind. Explore its advantages and learn through examples in this comprehensive guide. You will also encounter some examples.

-

Know-how May 15, 2024

Know-how May 15, 2024Uncovering the Transfer-For-Value Rule in Insurance: A Layman's Guide

Curious about how the Transfer-For-Value Rule affects insurance? Dive into this conversational article for an easy-to-understand breakdown of what it entails, its implications, and how it works in the realm of taxes.

-

Mortgages May 15, 2024

Mortgages May 15, 2024All You Need to Know About Pre-Approval

Learn about pre-approval in finance, how it functions, and different kinds to grasp its importance in various situations.

-

Know-how Dec 18, 2023

Know-how Dec 18, 2023Domestic Asset Protection Simplified: Financial Security Unveiled

Discover the importance of a Domestic Asset Protection Trust (DAPT) in safeguarding your assets. Learn how a DAPT works, its benefits, and strategies for maximizing its protections. Explore the role of jurisdiction and the value of professional advice in crafting a successful DAPT.