What Are The Differences Between Per Stirpes And Per Capita Estate Distributions?

Dec 03, 2023 By Susan Kelly

In wills, including revocable lifetime trusts, Per Stirpes vs. Per Capita Estate Distributions the words "per stripe" and "per capita" are often used for estate planning. They detail who you wish to inherit your property and what happens to a bequest when one of its recipients dies before you do. A will is among the most fundamental components of an estate plan and one you may want to consider including. A trust may be required if your estate is very complex. A person's wishes about the distribution of their estate might be memorialized in either a will or a trust.

What Is The Meaning Of Per Stirpes And Per Capita?

Should your heirs or beneficiaries seem no longer alive when you die, their inheritance will be distributed per stripe amongst their descendants. If children predecease a beneficiary, the legacy that would have been paid to the dead beneficiary would indeed be distributed "by representation" to the children. Only the specified recipients may get per capita payouts. They are not transmitted to subsequent generations. If a beneficiary predeceases the deceased, the assets go back into the estate and are divided evenly among the surviving heirs.

Per Stirpes Distribution Examples

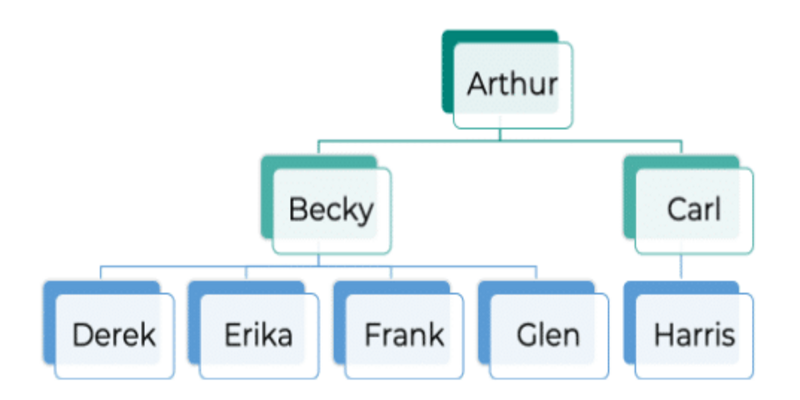

Let's pretend your name is Smith, and Ann, Bart, and Carl are your three offspring. Ann is the proud parent of two wonderful kids, Drew but instead Eve. No one descended from Bart, Carl, Drew, or Eve:

- If your will or trust specifies that your estate should be given to your "then live descendants, per stripe," the following situations may arise.

- If Ann, Bart, Carl, Drew, and Eve all outlive you, Ann, Bart, and Carl would each get a third of the inheritance. As a result, neither Drew nor Eve will get anything.

- Bart and Carl would each inherit a third of the estate if Ann had predeceased you, along with Drew and Eve. Both Drew, but instead, Eve will earn one-sixth of the total. Since one-third of the accommodation is six-eighths, they would each get one-sixth of what Ann would have received via representation and equal portions.

- If you leave property to Ann and Carl and they outlive you, but Bart does not, Ann and Carl will each get one-half of the estate. Since Bart passed away before you and left no heirs, he will not be given a share. As a result, neither Drew nor Eve will get anything.

- If you and Ann or Drew die first and Bart, Carl, and Eve survive, you, Bart and Carl will each get a third of your estate. Eve will get a one-third cut. She effectively assumes Ann's responsibilities. Since Drew passed away before you and left no heirs, there is no need to establish a stake in his name.

- Using per stripe during estate planning ensures that your wishes are carried out in the event of the birth or death of any typical family member without the need for frequent revisions to the will. Latin means "by representation", meaning "by class," per strip means just that.

- Since they account for the usual family circumstances, stripe payments are employed more often in real estate transactions than per capita payouts.

Per Capita Distribution Examples

If your will specifies that your "then alive descendants, per capita" are to inherit your estate, the following will occur.

- To the extent that Ann, Bart, Carl, Drew, and Eve have predeceased you, they will be entitled to a one-fifth part.

- If Ann has passed away but you, Bart, Carl, Drew, and Eve are still alive, each of you will get a quarter of the estate.

- If Ann, Carl, Drew, and Eve have all outlived you, but Bart hasn't, each of them will get a quarter of the estate.

- If Ann and Drew have passed away and you're still around to divide your estate, each Bart, Carl, and Eve will get a third.

- Per capita means "per head" in Latin.

- If distributions are to be made per capita, all eligible recipients will receive the same amount. If a member of the designated group dies, no new share will be issued, and the existing claims of the remaining beneficiaries can be raised proportionally. The heirs would have to take on the deceased's part of the estate following their respective shares.

Conclusion

These choices need attention to the difference between per stirpes and the per capita allocations. When you draft your will or other estate documents, these concepts will come up. The difference between per stripe and capita is explained in more detail below. You may specify who nonetheless gets your stuff when you die. Beneficiaries are the individuals or organizations you identify in your will as the recipients of your assets. Designating your estate's recipients and backup beneficiaries is crucial. If your primary beneficiaries cannot acquire assets, these "alternative beneficiaries" will.