Single vs Double vs Triple Net Leases: What's the Difference

Feb 03, 2024 By Triston Martin

Single net leases require tenants to pay only real estate taxes in addition to rent, rather than both rent and taxes. Tenant payments include rent, property taxes, and insurance premiums when a lease is structured as a "double net." There are three additional costs that the renter must pay on top of rent when signing a "triple net" lease, which is also called a "net lease."

In the case of net leases, the lower the baseline rent a landlord charges, the more expenses a tenant must cover. However, triple net leases are frequently bonded leases, which means the tenant can't leave since the costs, especially maintenance expenses, are greater.

Single Net Leases

Single net leases, or "N" leases, are not as widespread in the rental market as they used to be. The landlord assumes no risk because the tenant is responsible for paying the property taxes. This means the landlord is responsible for all other costs, including insurance, repairs and maintenance, and utility bills.

During the lease term, the landlord is also liable for any repairs or maintenance needed on the property. Because of the additional expense of paying property taxes, tenants with a single net lease pay significantly less in rent than those with a conventional lease.

On the other hand, a larger rent payment has no effect on the landlord's obligation to keep up with these costs. For example, landlords may be held responsible if a tenant fails to pay municipal taxes.

These could lead to further costs and fines. Because of this, most landlords require tenants to pay their share of the property taxes as part of their monthly rent. It's in their best interest to have the payment go via them, so they can be sure that the taxes are paid on schedule and in the proper amount.

Double Net Leases

There is a growing trend in commercial property to use "NN" leases, often known as double net leases or, ultimately, leases. The tenant is responsible for paying land taxes and insurance charges as part of the rent.

Because of additional costs, the renter must cover, the basic rent—the amount due for the space—is typically lower. On the other hand, the landlord is responsible for all maintenance costs, which they pay for directly.

Tenants can have a higher floor space than their neighbours in major commercial buildings, including retail malls and vast office complexes. As a result, landlords often charge renters a percentage of the taxation and insurance costs based on the size of the space rented.

A similar arrangement to the single net lease should be used to pass on extra fees to landlords so they may pay them to the city and insurance companies. Even if the tenant's contract involves these payments, the owner's identity is on the tax and insurance statement, which means they are wholly accountable.

The landlord can minimize late or missed payments from tenants, which could result in additional costs, by letting the tenant pay these expenditures directly to them.

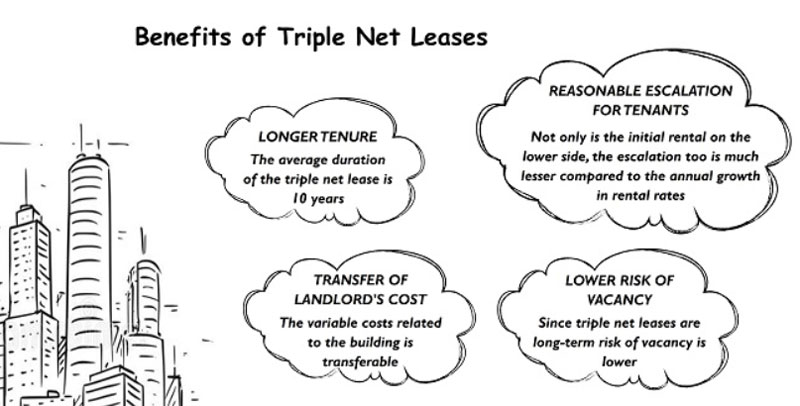

Triple Net Leases

A triple net lease exonerates the owner of the greatest liability of any net leasing. This means that in addition to the rent, real estate taxes, and insurance payments, the renter is liable for the cost of structural upkeep and repairs.

The landlord can charge a lower base rent because these additional costs are passed on to the renter. Tenants with triple net leases frequently try to get out of their contracts or receive rent cuts when servicing costs are higher than projected.

Many landlords utilize a bondable net lease to prevent this from happening. Unlike other types of triple net leases, this one can't be terminated before the end of its term. In addition, the rent cannot be changed for any reason, even if the auxiliary costs rise by a large amount.

Triple net leases can increase a tenant's operational costs and put them on the hook for insurance deductibles. Losses to the business that aren't covered by insurance may also fall on them. Most triple net leases are lengthy, typically for further than 10 years, and they often include restrictions for rent increases.

Special Consideration

Rent payments may rise while signing any lease form, even if it doesn't involve additional expenses or notes. Because municipal laws allow rent hikes, a landlord may be able to raise the rent. Real estate tax evaluations or hikes in insurance premiums may also lead to an increase in rent.

However, other options exist. Gross leases, which offer a fixed rental amount, may be an alternative for tenants who are given a choice. This sum covers the rental charge and any other costs.

This means that the landlord retains the obligation to pay for property taxes, insurance fees, and maintenance charges. The rent they pay their tenant covers these expenses.

If the annual rent is $10,000 and the additional costs are estimated at $3,000, the rent that the landlord charges the renter is $13,000 yearly, for instance. Conventional leases are more prevalent than net leases, but they put the landlord at greater risk because they must cover any rises in the additional costs.

Using a sort of net lease, some landlords seek to shift part or all of this risk onto their tenants. A modified gross lease can also replace a net lease. At the start of the lease, the renter pays the base rent.

Additionally, a percentage of other costs related to property ownership, such as real estate taxes and utilities, is shared by tenants over time.